Luxury is an experience not a price point

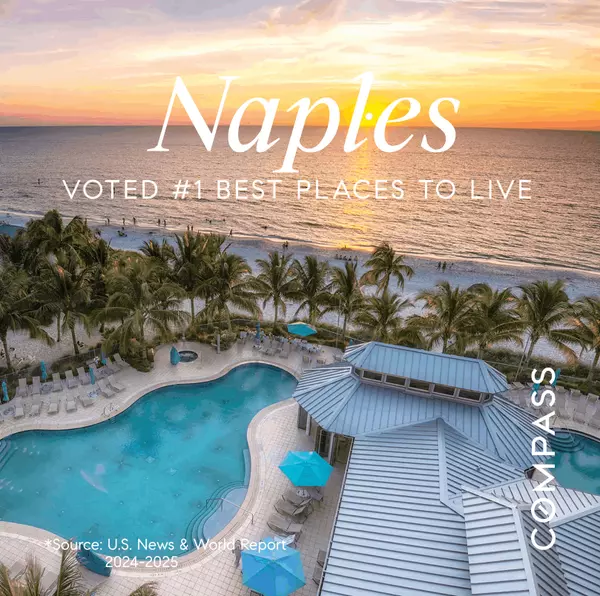

Naples, Florida: Voted #1 Best Place to Live in 2024-2025

Naples, Florida, has earned the top spot as the best place to live in the U.S. for 2024-2025, according to U.S. News & World Report. With its stunning beaches, upscale lifestyle, and sunny weather, Naples appeals to retirees and snowbirds, yet offers something for everyone. The city is known for p

Read MoreHurricane Milton: Impact, Recovery, and a Bright Future for SW Florida

As SW Florida, navigates the aftermath of Hurricane Milton, residents and businesses are once again reminded of the power and unpredictability of nature. The storm, which made landfall as a Category 3 hurricane, brought heavy winds, storm surges, and widespread flooding across Collier and Lee Coun

Read MoreNavigating New Horizons: Understanding Florida Senate Bill 154 and Its Implications for Condo Safety

In the wake of tragic events and escalating concerns over building safety, Florida has taken a decisive step forward with the enactment of Senate Bill 154 in 2023. This legislation, emerging as a crucial amendment following its predecessor, SB 4D, seeks to address ambiguities and enhance the structu

Read MoreThe Ultimate Guide to Buying a Condo in Southwest Florida

Hello there! If you've clicked on this blog, chances are you're considering investing in a condominium in the beautiful region of Southwest Florida. Well, you're in the right place. Whether you're a seasoned investor or a first-time buyer, this guide aims to provide you with valuable insights to mak

Read MoreDiscover How Hurricane Ian Changed SW Florida Real Estate Markets

Living in and around Southwest Florida comes with a unique set of benefits. From the beautiful, white sand beaches and vibrant sunsets to the year-round warm weather and abundance of recreational activities, SW Florida has earned its reputation as an ideal place for those looking to embrace a laid b

Read More-

Buying a house - whether it’s your first or fifth - can be a bumpy process. Between the financing, the availability (or scarcity) of homes on the market in your price range that meet your needs, the offer process, the appraisal and the inspection, there’s a lot that can go wrong between deciding tha

Read More Answers To Your Questions About Home Inspections

If you’re not familiar with home inspections, then you might have a lot of questions about what gets inspected, how thorough the inspectors are, why you even need one, and what you can expect if you’re walking with an inspector through the house you’re hoping to buy. There’s a lot to know about home

Read More10 Things Everyone Should Know About Real Estate Investing

Real estate investing is gaining popularity, and if you’ve been giving it some thought, this guide will give you an overview. The goal of any real estate investor is typically to make money. This means purchasing an investment property at a good price so you can rent it out and maybe eventually sell

Read More5 Essential Financial Steps To Take Before Investing In Real Estate

If you’ve been thinking about investing in real estate, getting your finances in order before you start searching for properties and scheduling appointments will save you from money headaches in the long run. Real estate investments could be one of your largest investments, and unless you have cash

Read MoreHow To Maximize A Small Living Space?

Between micro-apartments, tiny homes, and even #vanlife, the real estate industry is taking the saying “less is more” to previously unknown levels. And while we can all get behind the idea of streamlining your life and shedding possessions that no longer meet your needs. The good news is that as we’

Read MoreDeep-Cleaning Tips For Homeowners

If you've never owned a house before, then it's entirely possible that you've never deep-cleaned a house. (Hey, no shame in that game.) But when the house is yours, the desire to see it as clean and sparkling as it can possibly be is strong -- and you might have no idea where to start or how to go a

Read MoreWhat Your Agent Should Do For You?

Just like in any other profession, there are good real estate agents ... and there are, unfortunately, subpar real estate agents, too. But how do you know if you've got a dreamboat or a dud handling your real estate transaction? One way to know whether you've got a good agent (or not) is to consider

Read More10 Ways To Make Your Home Energy-efficient

Not too long ago in our country's history, talking about making your house "greener" might get you labeled a hippie tree-hugger. But times change, and as gas, electricity, and water prices creep up, more and more homeowners are seeing the (strong) advantages that come with considering the environmen

Read More

Categories

Recent Posts